Markets Are Strong Ahead of Key Earnings

- April 18, 2023

- Posted by: Noureldeen Al Hammoury

- Categories:

The US Equities began yesterday’s trading lower but managed to turn around at the last two trading hours, closing the day in green with over 0.3% including SPX, DJI, and Nasdaq Composite, while NDX managed to close higher by less than 0.1%. Markets Are Strong Ahead of Key Earnings

Over the past few weeks, despite that the general consensus is still bearish, markets have shown a clear resilience. If you look at the price action, it’s becoming buying the dips more than selling the rallies. We haven’t seen this for a long time, which should be watched very carefully over the next few days.

Since Inflation and economic activity indicators are showing a clear sign of slowing down, the only thing left for the market to move in trends is the earnings season. Over the past few days, we saw the banking sector earnings came with much better than expected results, while we wait for more earnings this week.

Earnings in Focus Today

| Company | EPS | Revenue |

| J&J | 2.5 | 23.6B |

| Bank of America (BAC) | 0.81 | 25.2B |

| Netflix (NFLX) | 2.86 | 8.17B |

| Goldman Sachs (GS) | 8.24 | 12.83B |

| United Airlines (UAL) | -0.73 | 11.43B |

DXY Double Bottom

The US Dollar Index managed to rally for two days in a row, but it also failed to hold above 102.0 declining back to 101.85 in Asia, losing about 50% of Monday’s gains. The downside outlook is still valid as long as it continues to trade below 103.0 this week. Selling rallies is still our strategy for the time being.

AUDUSD and NZDUSD

The Aussie and the Kiwi trades which got stopped out at breakeven multiple times are still on our radar. After the recent declines last week, we have a chance to buy at a cheaper price.

AUDUSD Price/Time chart is strong and suggests orderly gains over the next few weeks as long as it stays above the 26-degree angle from the low of October 2022 low. I am waiting for the right time to re-enter in the coming hours, while my stop will be below the recent lows of around 0.66 while targeting 0.69 over the next two weeks.

NZDUSD might be weaker than AUD, but Price/Time is still suggesting the same scenario. Yesterday we placed a pending over to buy at 0.6157, unfortunately, it did not get filled yet. We will place another order in the coming hours of we might just buy at a market during the European session. This time, our initial stop will be below yesterday’s low which would be below the 26-degree angle on the daily chart, if it breaks, then the general outlook will change to bearish once again.

Stocks and Indices

Our SPX longs from 4093 are still active with ½ of the position after closing the first ½ last week. Currently, it’s running with over 55 points. SPX closed yesterday’s trading above 4150, which is the highest daily close since February. I would decrease the size of the position right at the open tomorrow as a new supply area is ahead of us at 4180.

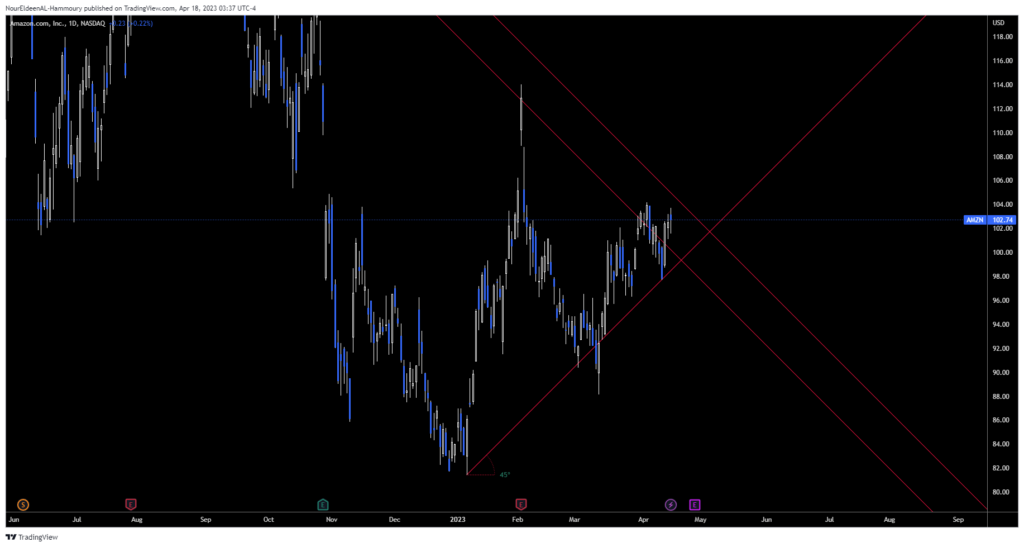

As for Amazon, I am willing to hold the options contracts through the earnings report, while it would be wise to trim our shares risk and close ½ of the position ahead of earnings, just in case, while keeping the full option contracts position.

Gold Below $2000

Gold failed to hold $2000 on Monday and closed the day below that support, which clears the way for further retracement ahead, possibly toward $1985 and $1980, which would be our next buying opportunity depending on the price action at these levels.

Patience will pay off