- May 4, 2023

- Posted by: Noureldeen Al Hammoury

- Categories:

The Federal Reserve decision was not surprising at all. We already talked about that in our previous reports and comments. The Federal Reserve removed The statement showed that the Fed dropped the language that it anticipates more policy firming may be appropriate to attain a sufficiently restrictive stance. The markets took this change in the statement as a clear indication that the Federal Reserve will pause in the next meeting. Moreover, Jerome Powell hinted that a pause is highly possible.

As for rate cuts, Powell noted that it is inappropriate at this time because they believe that inflation will take more time to go back to normal. Yet, the Federal Reserve was wrong about inflation when it was lower. Will the Fed be right about inflation this time? I doubt it. The same thing goes with recessions, the Fed never predicted a recession before. Today the Fed is anticipating modest growth. Will the Fed be right this time? I doubt it.

Therefore, the Federal Reserve is now giving the markets full control of pricing in the timing of the first rate cut, through the upcoming data. From now on, any economic release will have a much larger effect on the markets, as markets will start pricing in the first rate cut sooner than expected, especially if the data showed a faster slowing down in inflation or lower growth.

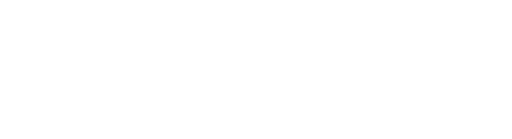

The Bond Market Remain The Key

Throughout history, the bond market always predicted recessions and key events accurately. After the Federal Reserve’s decision, the bond market made it clear that they do not believe that the Fed will not cut this year. So far, the market is pricing in at least one rate cut before the end of this year. Since the bond market was always right, it is highly possible that it will be right once again.

DXY Near Key Levels

The US Dollar Index remains within the same range, but this time it failed to hold above 101.50, trading at 101.0 key support, while the major support remains at 100.7. any daily or weekly close below those levels means that the downside move is likely to accelerate in the next two weeks. Therefore, we maintain our bearish outlook for the dollar and maintain selling the dollar against commodities-backed currencies.

ECB Decision Today

Markets are anticipating a 25bps rate hike following the recent slowing down in inflation. Yet, the differential between the Fed and the ECB is still significant and central banks are trying to cope with the Fed. Therefore, a 50bps rate hike should not be a surprise today, if the ECB raises rates by 25bps only, it will likely keep the door open for further and larger rate hikes if needed.

The Euro is still strong trading well above 1.10. This is not a level to buy the Euro, since it’s the highest level since March of last year. I’d rather wait to short than buy at the highest level in over a year. No trade on the Euro yet.

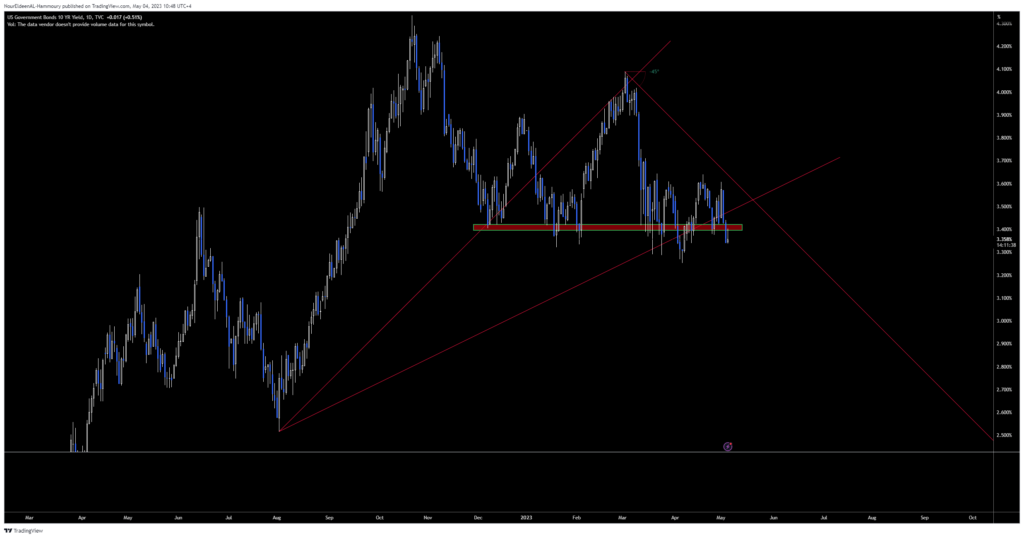

Brent Crude Jumps From Key Level

Brent Crude declined to 71.30 during the Asian session before it jumped by over 1.5%. Brent jumped from the 8-Deg angle on the daily chart, which is considered the best risk/reward angle. Following this jump, we will be watching for any retracement before we issue a new trade.

Gold Near Record High

During the Asian session, Gold spiked higher to as high as $2067 before retreating back to $2044. There were multiple Twitter verified stating that Russia has put its nuclear forces on high alert for retaliation for Putin’s assassination attempt. So far, there is no confirmation and all the accounts mentioned that it’s an unconfirmed report. If these reports are fake, gold may retreat back in the coming hours. Otherwise, any confirmation would likely push Gold to a new all-time high.