- May 15, 2023

- Posted by: Noureldeen Al Hammoury

- Categories:

The US Dollar Index Time/Price relationship expired a few days ago. Its Time to Buy USD. The Index declined for 45 days from the high of March 8th until May 10th, moving lower by 4.5 points. On Thursday and Friday, a new cycle has begun which is likely to continue for about two weeks. The new bullish cycle remains valid as long as the index continues to trade above the 100.80 support area. Therefore, from now on, our strategy shifts to buying the US dollar dip against most of the major currencies, preferably against the Euro and the British pound.

Closing AUDUSD and NZDUSD Longs

Since the US Dollar began a new cycle to the upside which may last for about two weeks, there is no reason to keep our AUDUSD and NZDUSD longs for now. We will revisit them after the US Dollar completes its retracement cycle. Closing both positions by the end of today’s session.

Gold Unable to Hold Over $2020

Daily and Weekly charts show a clear reversal, despite the fact that Gold is holding over $2000, its highly likely that this level will be breached later this week. Also Gold broke its 45 angle from the low of March 8th. Now any upside push is likely to be limited below $2035 – $2040. On the downside view, will be looking for a revisit of $2000 followed by $1980 and possibly $1970 in the coming weeks.

US Indices

SPX, DowJones, and Nasdaq are in a correction phase after the recent rally. Despite the fact that the Federal Reserve is likely to hold in the coming meeting. Indices need some breathing retracement before the upside trend resume. We will be watching SPX for a possible short around 4135 – 4140, while we will be looking for another leg lower towards 4100 as an initial target followed by 4060 for now.

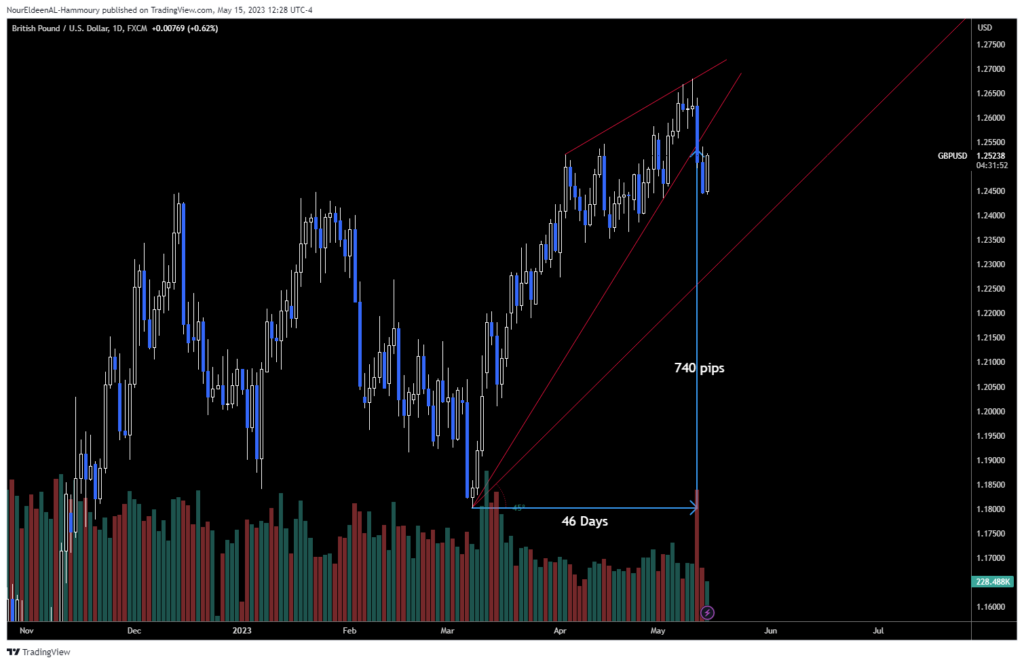

Short GBPUSD Around 1.2530’s

After the break of a major angle on the daily chart in addition to the rising wedge, any upside retracement is likely to be capped below 1.26. Therefore, we will start our positioning from 1.2530’s. The downside view remains intact as long as it continues to trade below 1.2680. On the downside view, we will be targeting 1.2350’s as an initial target followed by 1.2240 within the coming two weeks.

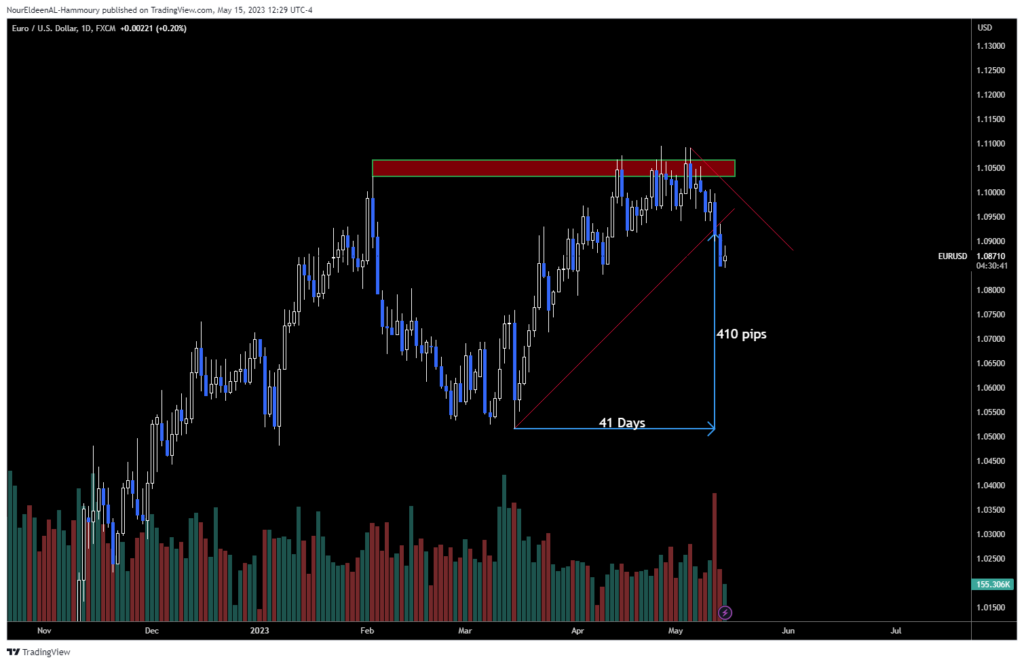

Short EURUSD Around 1.0900

EURUSD broke multiple key levels over the past few days and also broke major angles on the daily chart, which switch the outlook to bearish in the short term. Such a move is likely to continue for about two weeks until the US Dollar completes its retracement phase. Therefore, we will be looking for a short EURUSD around 1.0900 with an initial target of 1.0750, while the downside view remains intact as long as the euro continues to trade below 1.1100.

GBPAUD on Watch

GBPAUD rallied over 10% within 60 days. Currently, Price/Time are almost equal. From February’s low to today’s low, its 72 trading days, while the pair is up by 1432 pips. The moment you see a daily close below 1.8640, this is our short trigger for the next few weeks. The initial target for this trade stands at 1.8345 followed by 1.8130 within two weeks or so.