All Eyes Are on US Inflation Data Today

The most important day of the week is finally here, as everyone is waiting for the US inflation data, which is expected to be released later today and likely to have a major impact on the markets, which is likely to last at least until the end of the week.

| Economic Indicator | Forecast (Dec) | Prior (Nov) |

|---|---|---|

| US Core CPI YoY | 5.7% | 6.0% |

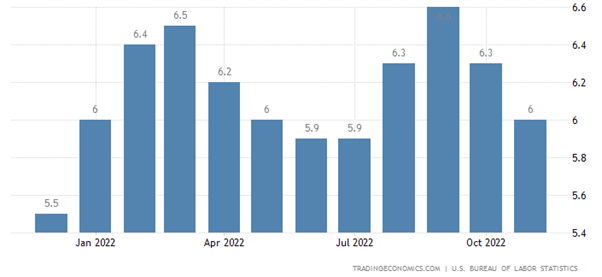

| US CPI YoY | 6.5% | 7.1% |

| US Core CPI MoM | 0.3% | 0.2% |

| US CPI MoM | 0.0% | 0.1% |

Today’s trading should be straightforward, it’s either good news or bad news, nothing in between. There are two major scenarios:

1: Better than expected data: a decline in Core CPI and CPI on both YoY and MoM. Such outcomes will be welcomed by equities while the US Dollar might take another dive below 102.50’s.

2: Surprise higher: This is less likely given the fact of recent slowing down in energy, services, and manufacturing data. In return, such outcomes will keep the door open for 50bps rate hike by the Fed in its next meeting, while equities may erase this week’s gains and the US Dollar Index may jump over 103.50’s.

The only thing that may confuse the market and the reaction might be mild is if the Core CPI stabilizes and the CPI ticks higher. This is something that might lead to a mild move as the market will shift its concentration toward new data next week.

10 Yr Suggesting Further Gains in SPX

The US 10-Year Yield failed to reclaim 3.6% this week, which represents the broken up-trend on the daily chart, suggesting a continuation to the downside. According to Price / Time theory, the US 10 Yr yield could be heading towards 3.3% by March.

SPX was able to post further gains for the 2nd day in a row and closed yesterday’s trading at the highest level since Dec 14th, while the next resistance area stands at 3975 followed by 4000 which could be seen today if inflation slows down faster than expected.

DXY May Test 100.5 In The Coming Days

The US Dollar Index continues to show lower highs pattern on the daily chart after it failed to reclaim the 105.0 resistance area. The upcoming data may lead to another leg lower, possibly towards the 100.50 key support area before any upside retracement as long as inflation keeps on slowing down.

Gold vs. Inflation

Gold will be under the spotlight today as well, as inflation data will be another key factor. However, despite the slowing down in inflation for the past few months, Gold was able to hold some ground. Gold has been rising since the beginning of November. One of the main drivers of this move is not inflation, it’s the US Dollar’s recent decline and today is no different. Slowing down in inflation doesn’t necessarily mean that Gold will erase its recent gains, but a weaker US Dollar would keep gold within its up trend that started in November and is likely to continue with the possibility to test $1900 over the coming weeks.