US Jobs Report Preview — During the US session today, traders and investors will be waiting for the release of the US Jobs Report for the month of October, which is likely to have a major impact on the markets, depending on how significant the surprise will be, whether positive or negative.

Over the past few weeks, some economic data related to the labor market suggests that today’s jobs report is likely to be mixed.

The table below summarizes some of the related labor market data.

| Indicator | October | September |

| ISM Manuf. PMI Employment | 46.8 | 51.2 |

| Jobless Claims 4 Week MA | 210K | 209K |

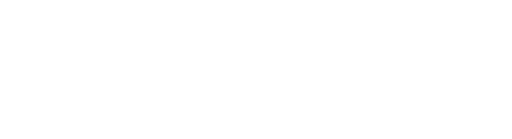

| ADP Non-Farm Employment | 113K | 89K |

| Challenger Jobs Cut | 8.8% | 58.2% |

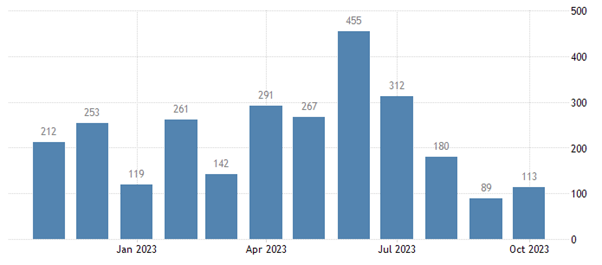

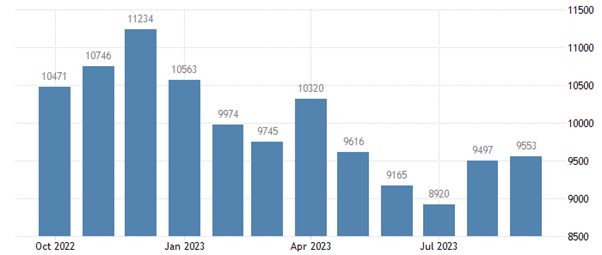

| JOLTS Job Openings | 9553K | 9497K |

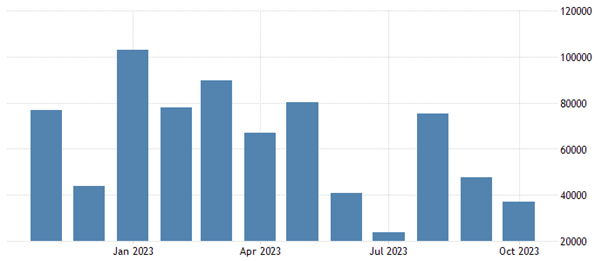

| Continuing Jobless Claims | 1818K | 1705K |

The ISM Manufacturing Employment Index shrunk again to 46.8 in October down from 51.2, which is the lowest level since July of this year.

Despite the fact that the ADP Non-Farm Employment Change increased by 113K in October, it came well below the market estimates of 130K

The Challenger Jobs Cut showed an increase for three months in a row, not seen since April of this year.

Continuing Claims also posted the highest level since 2021 with 1818K up from 1705K. while the 4 Weeks MA of Jobless Claims increased slightly.

The only positive outcome came from the JOLTS Jobs Openings which advanced for the 2nd month in a row, posting the highest level since May.

Expectations

| Indicator | Estimates | Prior |

| Change in Nonfarm Payrolls | 180K | 336K |

| Change in Manufact. Payrolls | -10K | 17K |

| Unemployment Rate | 3.8% | 3.8% |

| Average Hourly Earnings MoM | 0.3% | 0.2% |

| Average Hourly Earnings YoY | 4.0% | 4.2% |

In general, estimates are pointing to a softer jobs report compared to the previous one. However, the most important indicator might not be what you think in today’s report. Yes, it’s not about how many jobs the economy added last month, but it’s about the wage growth.

A few days ago, the Employment Cost Index ticked higher in Q3 to 1.1% up from 1.0% in Q2, suggesting a possible inflation in wages.

Scenarios

As noted before, wage growth remains the key in today’s report, even if the economy added more jobs than expected. Below are the possible scenarios.

Ultimate Membership Required

You must be a Ultimate member to access this content.

Join our live coverage of the US Jobs Report and other live trading sessions by visiting our webinars page