Over the past few days, the US Dollar Index has continued its decline, reaching its lowest level since election day. The dollar has essentially lost all the gains it posted since election night, dropping as low as 104.50 by the time this report was released.

Was this move a surprise? Absolutely not! Since the beginning of the year, I have advised my subscribers not to jump on the hype of a stronger dollar. The tariffs and the Trump administration’s policies were already priced in. Watch out for overestimating the move.

Time & Price Method Strikes Again

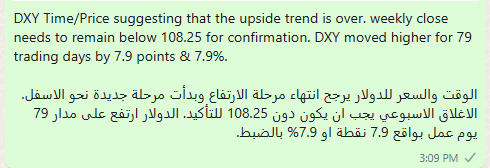

On January 16th, I sent the following message to our Ultimate Subscribers Group:

Back then, the Time/Price Method indicated that the upside move was over, so we started positioning ourselves ahead of what we are seeing today. Since that day, the dollar has lost about 4%.

This move happened despite the overwhelming “general consensus” at the time that the dollar’s bullish move had just begun. What actually happened was the exact opposite.

How Are Our Trades Looking Now?

In short, we are now up by over 500 pips on our combined EUR/USD trades alone and more than $1 per ounce on silver. We still have ongoing trades in gold and AUD/USD, but overall, our portfolio remains in profit.

And that’s what matters most. Profits are balancing our losses. Moreover, our ongoing negative positions are gradually recovering, and we will likely average them over the next few days.

Some of my subscribers complain that each trade takes time. Yes, it does. But what matters most is the outcome. What’s better? Jumping from asset to asset every day to try and make 20 pips? Or positioning yourself ahead of the move, holding, waiting, and banking hundreds of pips?

I’ll let you decide.

Services Update

Over the past few days, we have been working on upgrading our services, and we are now in the final testing phase. The new update will be available across all apps in the next few weeks.

This update includes:

Advanced News Feed: This will be the most advanced news feed available for retail traders. Instead of a single list of news, topics will be categorized, and you will be able to filter them to suit your needs.

New Audio Squawk: The new Audio Squawk is already available on the website, Windows, and Android apps. It now runs 24 hours, 5 days a week. Additionally, a new AI-generated Arabic Audio Squawk will be available very soon.

Introducing Markets Live Blog: This will feature frequent short updates throughout the day with the latest market developments.

Expanded World Interest Rate Probability Tool: The tool will now cover all major central banks, not just the Federal Reserve.

In light of these upgrades, we will no longer accept new registrations under the Premium Plan. Moving forward, we will maintain only the Free and Ultimate subscription tiers..