Key points

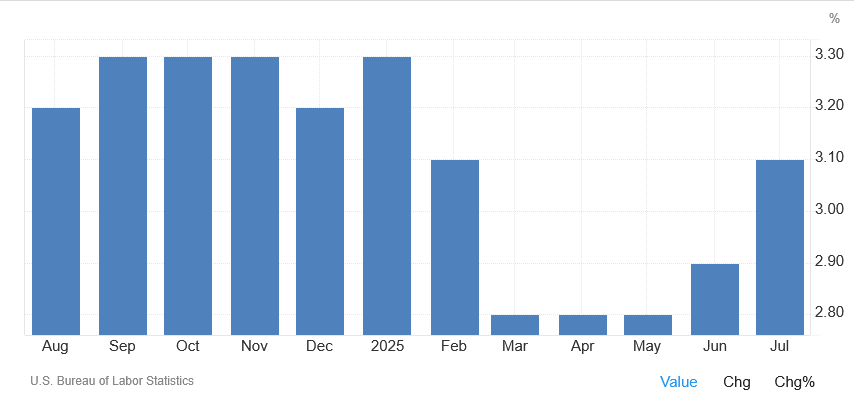

- Core CPI rose to 3.1% YoY in July, with services (“supercore”) still sticky.

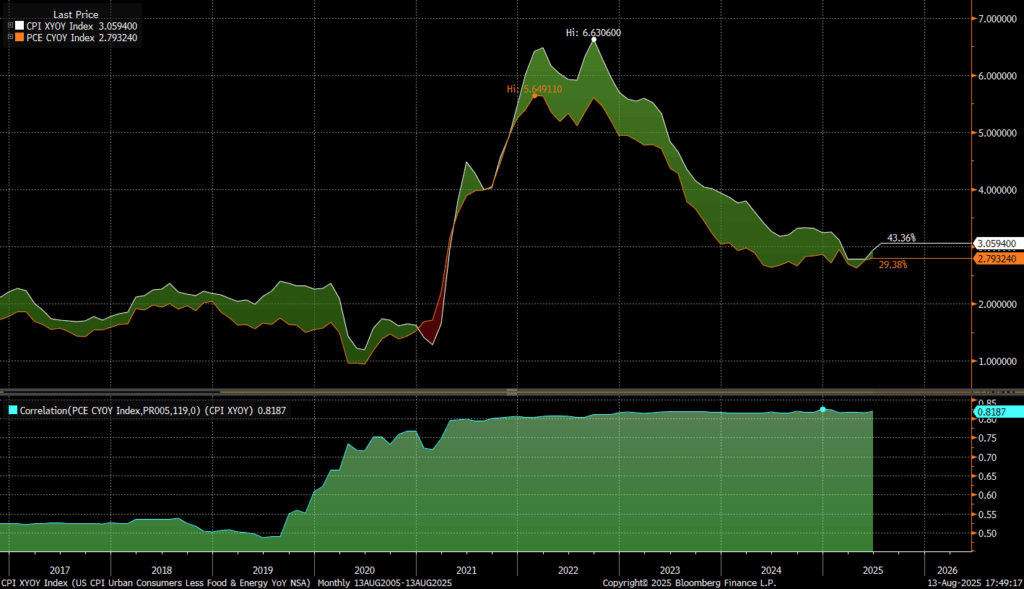

- Given the usual CPI→PCE gap and their strong linkage (≈0.8 YoY; ≈0.4 MoM), July Core PCE likely lands around 2.9–3.0% YoY, with a ~0.24–0.27% MoM print—more plateau than progress toward 2%.

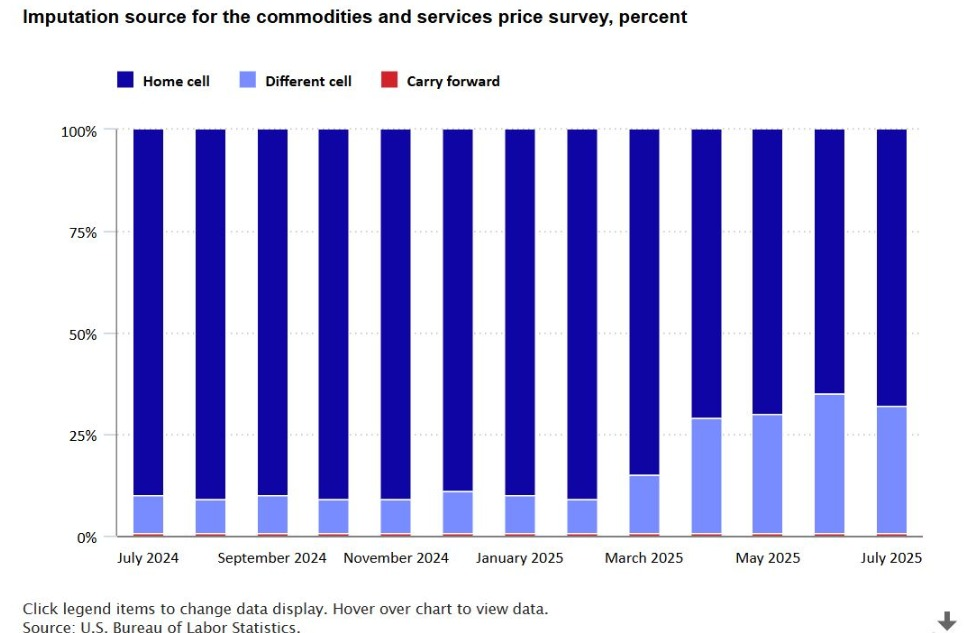

- CPI imputation (prices estimated rather than observed) remains elevated (~32% in July), widening error bars and risking delayed tariff pass-through in measured inflation.

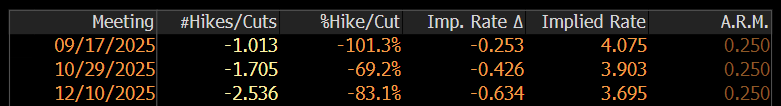

- Markets still price a 90–95% chance of a 25 bp cut in September, but pricing isn’t policy; sticky services and tariff-supported goods keep the bar high.

Where Inflation Stands

Disinflation has stalled. Core measures have hovered in a 2.7–3.1% band for roughly a year. Monthly run-rates near 0.20–0.27% translate to ~2.5–3.2% annualized, not the ~2% the Fed targets.

Projection for July PCE: Given Core CPI at 3.1% YoY and PCE’s tendency to print a bit softer, Core PCE likely edges toward ~2.9–3.0% YoY, with a ~0.25% MoM outcome plausible.

What’s Driving the Stickiness

- Services inflation remains firm, consistent with wage-intensive categories and “supercore” momentum.

- Goods inflation is no longer a reliable drag. Tariff pass-through has lifted landed costs, keeping a floor under goods prices.

Data Quality Quirk: Imputation

When the BLS cannot observe a price, it imputes it from comparable items/areas. The share of such items remained elevated (~32% in July) after spiking since April. That doesn’t prove inflation is higher or lower, but it adds noise and could delay the visibility of tariff effects in the CPI.

Tariffs and Prices—A Reality Check

Tariffs are taxes on imports paid by U.S. importers and typically passed through along the supply chain. Historically, pass-through has been significant for import and consumer prices, implying a modest goods reflation tailwind.

Market Pricing vs. Policy Reality

Futures imply 90–95% odds of a September cut, but the Fed’s reaction function is data-dependent:

- Cut more plausible if the run-rate cools (≤0.15–0.17% MoM) and labor softens.

- Hold (or a one-off hawkish “calibration” cut) more consistent if MoM stays ~0.20–0.25% and labor merely slows.

- Hot inflation + clearly weakening labor (true stagflation) argues against easing unless financial-stability or employment risks dominate.

What to Watch Next

- Aug 29: Core PCE—focus on MoM and 3m/6m SAAR.

- Early September: Jobs report (revisions, unemployment rate, claims trend).

- Pre-FOMC CPI: Confirmation/refutation of services stickiness.

- Any changes/controversy around data publication: Credibility shocks affect term premium and risk sentiment.

Bottom Line

The inflation picture looks incomplete and stubborn: services are sticky, goods are firming on tariffs, and measurement noise is higher than usual. That combination boxes the Fed in. Markets may keep pricing a cut, but without softer run-rates or a clearer labor break, the case for holding—or at most a hawkish, one-time trim—remains strong.