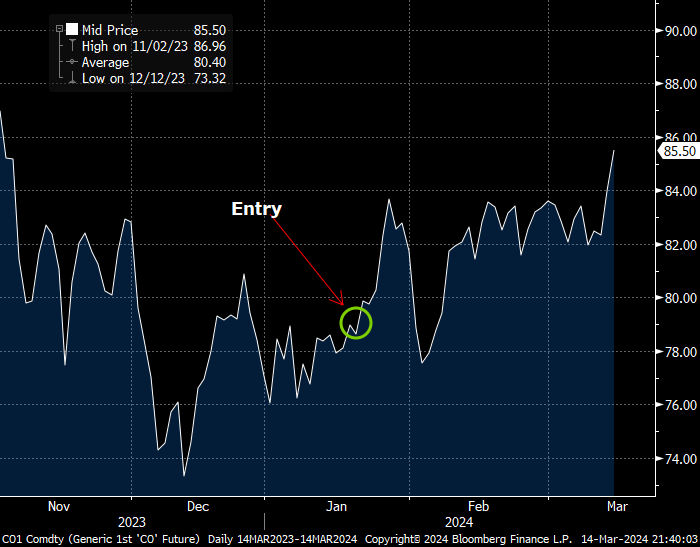

Is This The Turning Point? – After two months, our long positions on Brent Crude from 79.29 have yielded over 600 pips following its breakout from a tight range.

It may be wise to close some of the position and take profits after this breakout, unless you prefer to wait for another opportunity for a bigger move higher. So far, the breakout seemed solid and paves the way for further gains ahead.

US Data Revisions Continue

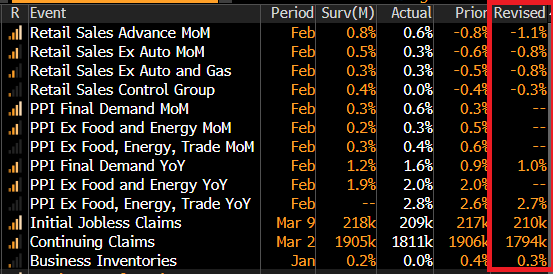

The frequent revisions to US economic data have made it difficult to predict the timing of the Federal Reserve’s first rate-cut decision.

US retail sales for February missed expectations with a lower-than-anticipated increase. January’s data was also revised lower to -1.1%. The core retail sales also fell short of the estimated rise, increasing by only 0.3%. These outcomes suggest that Q1 growth may be revised downwards.

PPI data was higher at 0.8%, the most since August of last year. Core PPI also increased by 0.3%, slightly more than expected. The market got worried.

The YoY PPI has now reached its highest level since October, while the Core PPI remained stable at 2.0%, though it was expected to slow down to 1.9%.

Ultimate Membership Required

You must be a Ultimate member to access this content.