Don’t Jump to Conclusions – As we await the Federal Reserve’s decision later today, I wanted to share a brief note on what traders should consider. Today’s FOMC meeting is particularly sensitive, as it comes during a complex market environment.

It’s Not Just Black or White

I often get the same question: What if they cut by 25bps? or What if they cut by 50bps? How will it impact indices, the USD, Gold, and other assets?

The Fed’s decision is not just a matter of black and white. It may create a shift in market direction, but that shift could be short-lived. Traders shouldn’t jump to conclusions based solely on whether the cut is 25bps or 50bps.

Today’s meeting includes more than just the rate decision—it also features the statement, the dot plot, economic projections, and the press conference. To understand how and why the market will react, you’ll need to read between the lines.

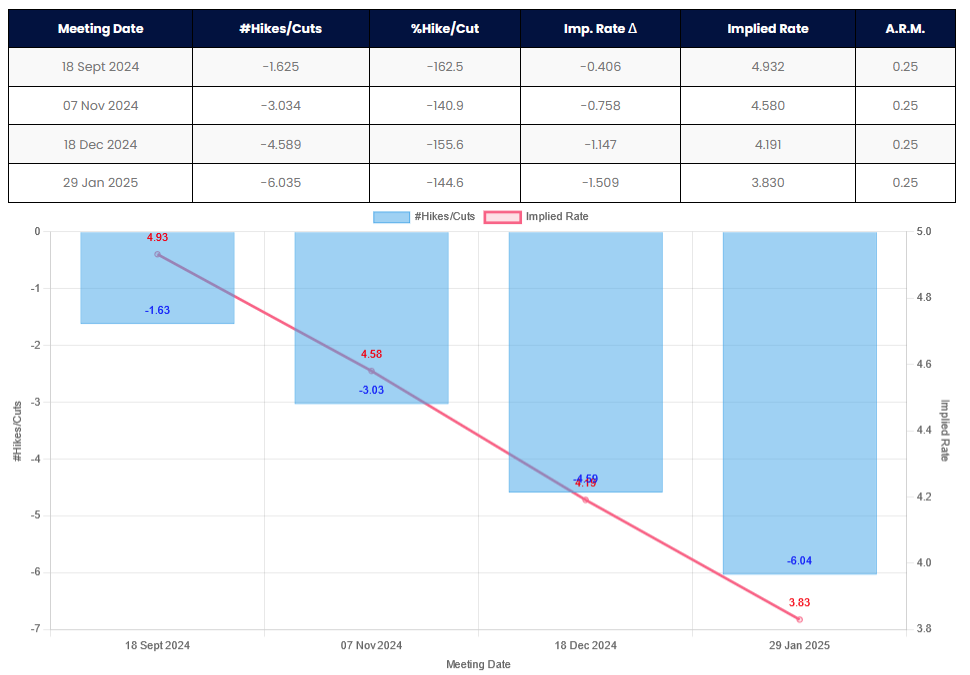

Keep in mind that as of now, markets have already priced in over 100bps worth of rate cuts through the end of the year. What truly matters is what the Fed signals about its future actions and its long-term outlook.

Fed Funds Futures

One crucial thing traders need to keep an eye on is Fed Funds Futures. I can’t stress this enough: if you want to know where the U.S. Dollar is heading, always monitor Fed Funds Futures. These are not usually accessible to retail traders, which is why we now offer them on our website. Register Here

Fed Funds Futures provide invaluable insight into what the market is pricing in and when. Even if it goes against your analysis or expectations, this information should guide your trading decisions. As far as I know, this tool isn’t available anywhere else.

I’ll still be hosting a live FOMC coverage webinar tonight. You can register by Clicking Here.